|

By Mark Wills - Course Instructor of the Loan Signing System, Forbes Real Estate Council Member, and Best-Selling Author

I'm always asked, “Mark, why don't banks, escrow officers, or title companies simply do their own loan signings in-house and save the borrower the $150 signing fee? Why do notary signing agents even exist?”Loan Signing Agents are Notary Publics — By Law, a Notary Public Cannot Notarize a Document in Which They Have a Financial Interest.

There has to be, what I call, a ‘separation of church and state.’

But what does this have to do with banks and home loans? Allow me to explain. Seeing as how the bank will be making thousands of dollars in interest on a mortgage, it’s safe to say they have a financial interest in the successful closing of a mortgage transaction. Meaning, banks cannot notarize and sign their own loan documents. They need a neutral third party to do that, which is why they rely on escrow or title offices to find a notary loan signing agent. Naturally, the next question is, how come escrow and title offices don’t just employ loan signing agents to save the borrowers a $150 loan signing appointment fee? Or better yet, why wouldn’t they hire a $15 per hour in-house notary, charge the borrower a $150 fee, and keep the difference as a markup or profit? It’s because they also need to keep themselves at arms-length from fraudulent activity. How Do Title, Escrow, and Mortgage Companies Keep Themselves at Arms-Length from Fraudulent Activity?

I'll tell you.

So, hypothetically speaking… Let’s say an escrow office or title office had an in-house employee notarize a deed of trust fraudulently because they were under pressure to close the loan. Suppose, for example, that the person who signed the deed was not the person who appeared in front of the notary. (Which is a big no-no, by the way) This fraudulent act by the notary could lead to monetary damages for the borrower, the bank, or the seller. Then all parties that were a victim of the notary’s fraudulent act can sue that escrow or title company... who — if found guilty — could potentially be out thousands or even millions of dollars in fines. Yikes. So how do escrow companies and title companies avoid nightmarish scenarios like the one above? You guessed it. They hire a neutral third party notary.

Now picture the exact same scenario… but this time, let’s say the fraudulent notary was a contracted independent loan signing agent. The escrow company or title company is not held liable for damages incurred by any fraudulent act(s) because they have kept themselves at arms-length from the loan signing.

See what I’m saying? This is why escrow and title companies will never have in-house loan signing agents and why our industry will always be around. They do not want to be held liable by a fraudulent notary that might be influenced to get a mortgage transaction closed. But they can’t just hire any notary public who has an active commission. They need to hire a notary public who has knowledge of the mortgage industry — a notary public who knows where a borrower needs to sign, date, and initial on the loan documents. Now we’ve come full circle. A notary public who can walk a borrower through a set of loan documents is known as a loan signing agent. And mortgage transactions in escrow states cannot close without one. Why Can't Banks or Escrow Offices Simply Send Out Documents to be Signed Via E-Signature?

In theory, this could eliminate a fraudulent notary AND act as a neutral third party, right?

This is a great question and understanding the answer is critically important. There are actually a few reasons why e-signings don’t occur:

At the most, if lenders began to allow e-signings, it would have to be a mixture of electronic signatures and printed out loan documents (like a deed of trust or mortgage), which would require live signatures and ultimately still necessitate a live notary loan signing agent. So now you have a solid idea about what a notary loan signing agent is and why they exist. And most importantly, you know why the notary loan signing industry will proceed to thrive and meet an ever-growing demand as the American housing market continues to expand. As long as there are homes, and as long as people get mortgages on those homes, there will be a need for notary loan signing agents. If you are interested in learning this in-demand skill that pays $75-$200 per hour-long appointment, take my five star-rated Loan Signing System online training course for notary loan signing agents — thousands of people across the nation are using my techniques right now to make hundreds or even thousands of extra dollars every month. I'm Mark, I teach Loan Signing System, and I look forward to giving you the tools to build a successful, efficient, and lucrative notary loan signing business today! |

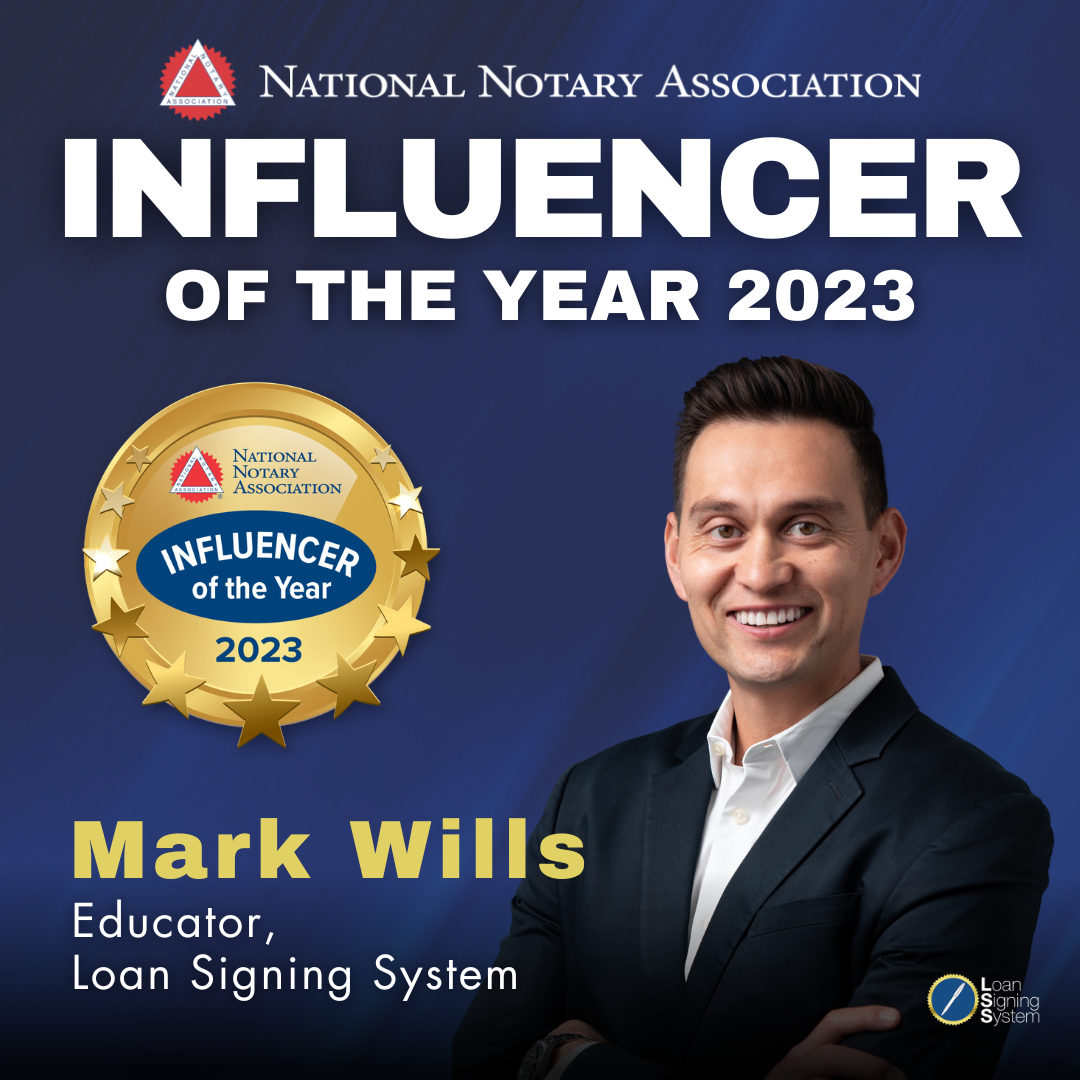

About the AuthorMark Wills is a Forbes Real Estate Council member, Loan Signing System Course Instructor & mentor to over 10,000 notary public business owners, and the National Notary Association's Influencer of the Year! Mark Wills is the course instructor of the #1 rated Loan Signing System notary public signing agent training course.

Loan Signing System has thousands of 5-star reviews and has transformed the fortunes of thousands of notary public business owners across the country! ⭐️⭐️⭐️⭐️⭐️ Click the link below to get the course! Archives

July 2024

|

- Homepage

- Courses

- Events

- Testimonials

-

FREE RESOURCES

- Get FREE Training

- 9 Reasons to Be a Signing Agent

- How To Become a Successful Signing Agent in 9 Steps

- How to Become a Notary Public

- Is This Right For You?

- Signing Service Owners Hire Notary Public Signing Agents

- Set Up a Google Business Profile for Notaries

- Four Ways to Get Signing Agent Business

- What is Remote Online Notarization RON?

- How to Get More Notary Jobs: FREE NNA Training

- How to Get More Notary Jobs

- How to Make More Money This Year

- LSS Signing Service Database

- Avoid Common Signing Agent Mistakes

- What Are Tax Deductions?

- Notary Hacks - Episode 1 >

- Maximize Your Notary Tax Deductions

- Snapdocs Interview

-

Notary Training

-

12 Ways to Make Money as a Notary

>

- Remote Online Notarization - Income Potential

- Apostille Agent - Income Potential

- Field Inspector - Income Potential

- Wedding Officiant - Income Potential

- Process Serving - Income Potential

- Permit Runner - Income Potential

- Estate Planning Notarizations - Income Potential

- Advanced Health Care Notarizations - Income Potential

- Mobile Fingerprinting - Income Potential

- Correctional Facilities Notarizations - Income Potential

- I-9 Verification

- Best Kept Secret for Notary Income

- Complete Notary Mentorship

-

12 Ways to Make Money as a Notary

>

- Blog and More!

- Student Login

- FAQ

- Homepage

- Courses

- Events

- Testimonials

-

FREE RESOURCES

- Get FREE Training

- 9 Reasons to Be a Signing Agent

- How To Become a Successful Signing Agent in 9 Steps

- How to Become a Notary Public

- Is This Right For You?

- Signing Service Owners Hire Notary Public Signing Agents

- Set Up a Google Business Profile for Notaries

- Four Ways to Get Signing Agent Business

- What is Remote Online Notarization RON?

- How to Get More Notary Jobs: FREE NNA Training

- How to Get More Notary Jobs

- How to Make More Money This Year

- LSS Signing Service Database

- Avoid Common Signing Agent Mistakes

- What Are Tax Deductions?

- Notary Hacks - Episode 1 >

- Maximize Your Notary Tax Deductions

- Snapdocs Interview

-

Notary Training

-

12 Ways to Make Money as a Notary

>

- Remote Online Notarization - Income Potential

- Apostille Agent - Income Potential

- Field Inspector - Income Potential

- Wedding Officiant - Income Potential

- Process Serving - Income Potential

- Permit Runner - Income Potential

- Estate Planning Notarizations - Income Potential

- Advanced Health Care Notarizations - Income Potential

- Mobile Fingerprinting - Income Potential

- Correctional Facilities Notarizations - Income Potential

- I-9 Verification

- Best Kept Secret for Notary Income

- Complete Notary Mentorship

-

12 Ways to Make Money as a Notary

>

- Blog and More!

- Student Login

- FAQ