What is a Tax Deduction?

How Can You Save Money on Your Taxes as a Notary Business Owner?

As a new notary business owner, you're likely juggling many responsibilities while trying to grow and manage your business in order to maximize profitability.

But do you know exactly what a tax deduction or write off is and how it works?

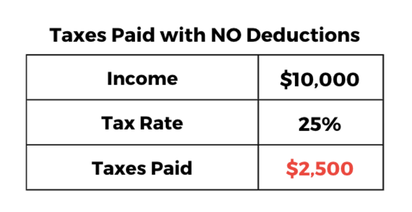

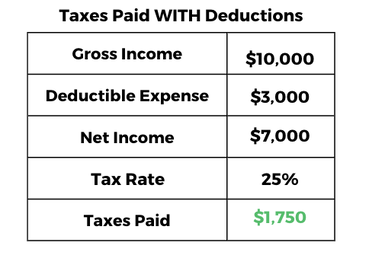

Tax deductions help reduce how much you pay in taxes, which means more money stays in your pocket or can be reinvested into your business.

However, if you're new to the concept of tax deductions, it can be overwhelming to know where to start.

So let’s explore an example of how tax deductions work for business expenses and why it's important to pay attention to your expenses as a notary business owner.

But do you know exactly what a tax deduction or write off is and how it works?

Tax deductions help reduce how much you pay in taxes, which means more money stays in your pocket or can be reinvested into your business.

However, if you're new to the concept of tax deductions, it can be overwhelming to know where to start.

So let’s explore an example of how tax deductions work for business expenses and why it's important to pay attention to your expenses as a notary business owner.