|

By Mark Wills - Course Instructor of the Loan Signing System, Forbes Real Estate Council Member, and Best-Selling Author

Errors and Omissions Insurance, also known as E&O Insurance, is liability coverage that is created to protect the notary loan signing agent’s personal and professional assets if a mistake is made during the notarial process that causes the client to suffer financial loss.Why Would You as Notary Public Loan Signing Agent Need Errors and Omissions Insurance if You Don't Plan on Making Mistakes?

This is a great (and incredibly valid) question, especially because notary public loan signing agents take their business, professionalism, and attention to detail very seriously in this industry.

So allow me to explain. The first thing to understand is that loan signing agents are first and foremost, notary publics — and as such, can be held personally liable for the full amount of damages caused by any wrongdoing that happens. Whether that wrongdoing is intentional or not. As a notary public loan signing agent, there are a lot of mistakes that can be made accidentally. Frankly, it's why we get paid so much money. However, if you are found liable for a mistake that occurs during a loan signing appointment, you will need to pay whatever the judgment dictates as well as the legal fees needed to defend yourself. This is why there is Errors and Omissions Insurance — also called E&O Insurance. Errors & Omissions Insurance Will Pay the Costs of Any Claims or Lawsuits that Result From Your Unintentional Errors, Up to Your Policy Limit.

So, if you have a $100,000 policy, it will cover you up to $100,000. Not only will E&O Insurance pay out damages to an injured party after a court verdict or out-of-court settlement, but it will also pay your attorney’s costs, court costs, and other defense costs up to your policy limit.

Remember, even if someone blames you for something you didn't do, you could still be faced with court costs for defending yourself. The beauty of Errors and Omissions coverage is that it would cover these costs for you. Meaning, nothing would not come out of your pocket. If the claim is legitimate, your policy will pay for your damages and legal expenses up to your policy limit. Talk about peace of mind! Errors and Omissions (E&O) Insurance is like car insurance — when you need it, you will be glad you have it. And like car insurance, it will cover your personal assets, even if you are falsely accused of wrongdoing.

Another great thing about Errors and Omissions insurance is that it will cover the insured notary for un unintentional actions performed during the term of their policy, up to the policy limit. Always be sure to read your fine print, but you can rest assured knowing that most carriers will cover you while your policy was in place. For example, let's say an error occurred in 2010 and you had a policy at that time. But someone blames you for misconduct a couple years later in 2012, after your policy has already expired. It is not unusual for the E&O insurance companies to cover resulting claims presented after a policy's expiration date if you were covered while the error took place.

However, there are a few misconceptions about this incredibly beneficial type of coverage... Many Loan Signing Agents Believe Their State-Required Notary Bond Acts Like Errors & Omissions [E&O] Insurance — It Does Not.

The Notary bond protects the public. If the surety company makes a payment on your claim, you are required to pay them back. Errors and Omissions [E&O] Insurance, on the other hand, pays your claim and legal expenses up to your policy limit — you don't have to pay a deductible and you don't pay them back for the claim. The state-required surety bond protects the public you are working for, not you. That is the difference between a notary bond and E&O insurance.

Understand that regular notary publics are not required by law to have Errors and Omission [E&O]. But as a notary loan signing agent, it's an absolute must . It reduces your risk of being held liable for any financial loss or potential lawsuits that can result from mistakes that occur on your behalf. And although it's not required for notary publics, know that 99% of escrow companies, title companies, and signing services do require it for notary loan signing agents. Those are your biggest sources of business. So my recommendation is to get a $100,000 policy at a minimum. That is what most title companies prefer. Plus, it allows you go about providing your notary loan signing agent services nearly worry-free, knowing that you'll never be on the hook for something you didn't do. Most Errors and Omissions [E&O] insurance carriers offer policies at this amount for around $20 a month or less — and for what you receive in exchange, I believe it is beyond worth it. If you found this information helpful, I'm stoked! There is so much more where that came from in my five star-rated Loan Signing System online training course for notary publics. Thousands of people across the nation are using my techniques right now to make hundreds or even thousands of extra dollars every month. I'm Mark, I teach Loan Signing System, and I look forward to giving you more tools just like this to help you build a successful, efficient, and lucrative notary loan signing business today! |

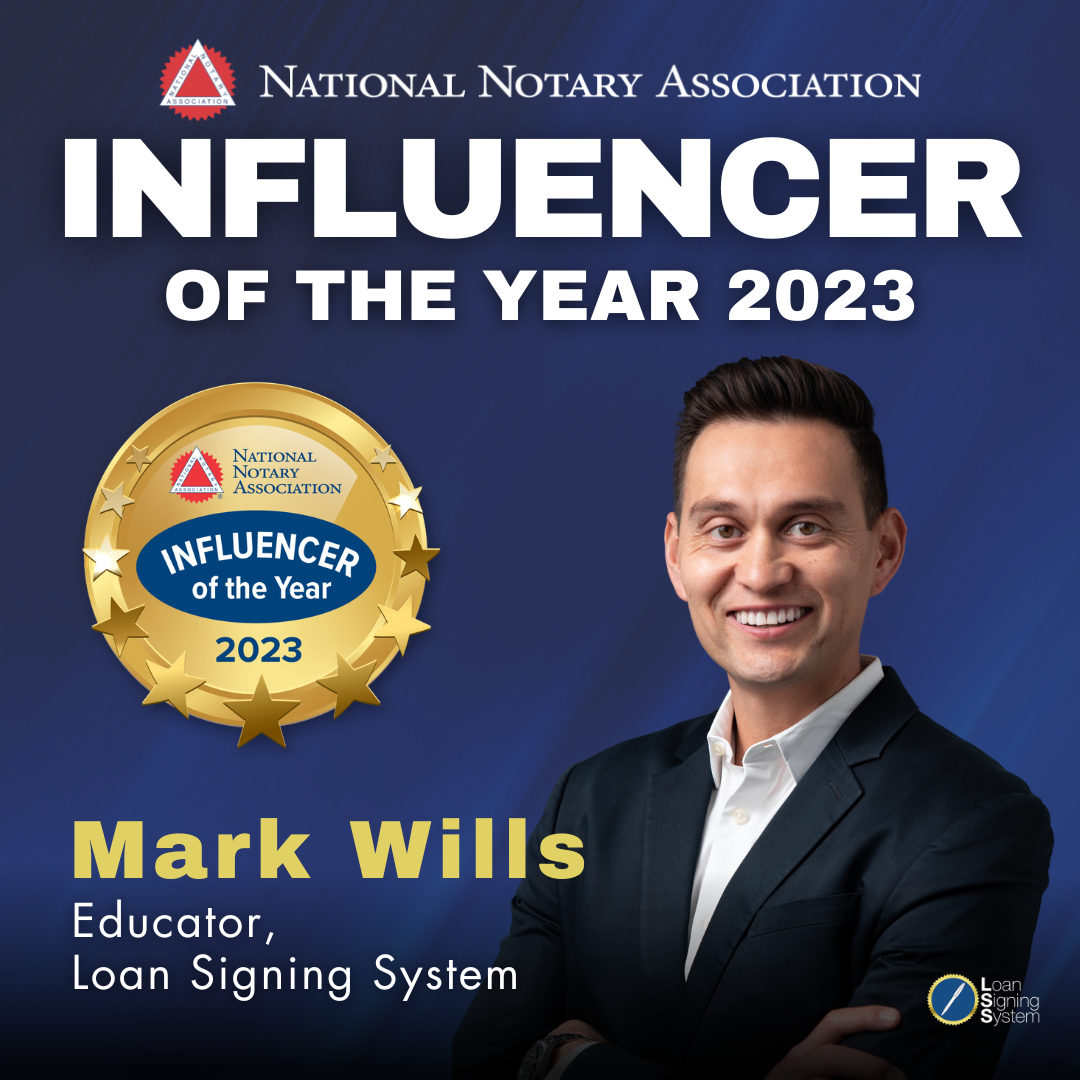

About the AuthorMark Wills is a Forbes Real Estate Council member, Loan Signing System Course Instructor & mentor to over 10,000 notary public business owners, and the National Notary Association's Influencer of the Year! Mark Wills is the course instructor of the #1 rated Loan Signing System notary public signing agent training course.

Loan Signing System has thousands of 5-star reviews and has transformed the fortunes of thousands of notary public business owners across the country! ⭐️⭐️⭐️⭐️⭐️ Click the link below to get the course! Archives

July 2024

|

- Homepage

- Courses

- Events

- Testimonials

-

FREE RESOURCES

- Get FREE Training

- 9 Reasons to Be a Signing Agent

- How To Become a Successful Signing Agent in 9 Steps

- How to Become a Notary Public

- Is This Right For You?

- Signing Service Owners Hire Notary Public Signing Agents

- Set Up a Google Business Profile for Notaries

- Four Ways to Get Signing Agent Business

- What is Remote Online Notarization RON?

- How to Get More Notary Jobs: FREE NNA Training

- How to Get More Notary Jobs

- How to Make More Money This Year

- LSS Signing Service Database

- Avoid Common Signing Agent Mistakes

- What Are Tax Deductions?

- Notary Hacks - Episode 1 >

- Maximize Your Notary Tax Deductions

- Snapdocs Interview

-

Notary Training

-

12 Ways to Make Money as a Notary

>

- Remote Online Notarization - Income Potential

- Apostille Agent - Income Potential

- Field Inspector - Income Potential

- Wedding Officiant - Income Potential

- Process Serving - Income Potential

- Permit Runner - Income Potential

- Estate Planning Notarizations - Income Potential

- Advanced Health Care Notarizations - Income Potential

- Mobile Fingerprinting - Income Potential

- Correctional Facilities Notarizations - Income Potential

- I-9 Verification

- Best Kept Secret for Notary Income

- Complete Notary Mentorship

-

12 Ways to Make Money as a Notary

>

- Blog and More!

- Student Login

- FAQ

- Homepage

- Courses

- Events

- Testimonials

-

FREE RESOURCES

- Get FREE Training

- 9 Reasons to Be a Signing Agent

- How To Become a Successful Signing Agent in 9 Steps

- How to Become a Notary Public

- Is This Right For You?

- Signing Service Owners Hire Notary Public Signing Agents

- Set Up a Google Business Profile for Notaries

- Four Ways to Get Signing Agent Business

- What is Remote Online Notarization RON?

- How to Get More Notary Jobs: FREE NNA Training

- How to Get More Notary Jobs

- How to Make More Money This Year

- LSS Signing Service Database

- Avoid Common Signing Agent Mistakes

- What Are Tax Deductions?

- Notary Hacks - Episode 1 >

- Maximize Your Notary Tax Deductions

- Snapdocs Interview

-

Notary Training

-

12 Ways to Make Money as a Notary

>

- Remote Online Notarization - Income Potential

- Apostille Agent - Income Potential

- Field Inspector - Income Potential

- Wedding Officiant - Income Potential

- Process Serving - Income Potential

- Permit Runner - Income Potential

- Estate Planning Notarizations - Income Potential

- Advanced Health Care Notarizations - Income Potential

- Mobile Fingerprinting - Income Potential

- Correctional Facilities Notarizations - Income Potential

- I-9 Verification

- Best Kept Secret for Notary Income

- Complete Notary Mentorship

-

12 Ways to Make Money as a Notary

>

- Blog and More!

- Student Login

- FAQ