|

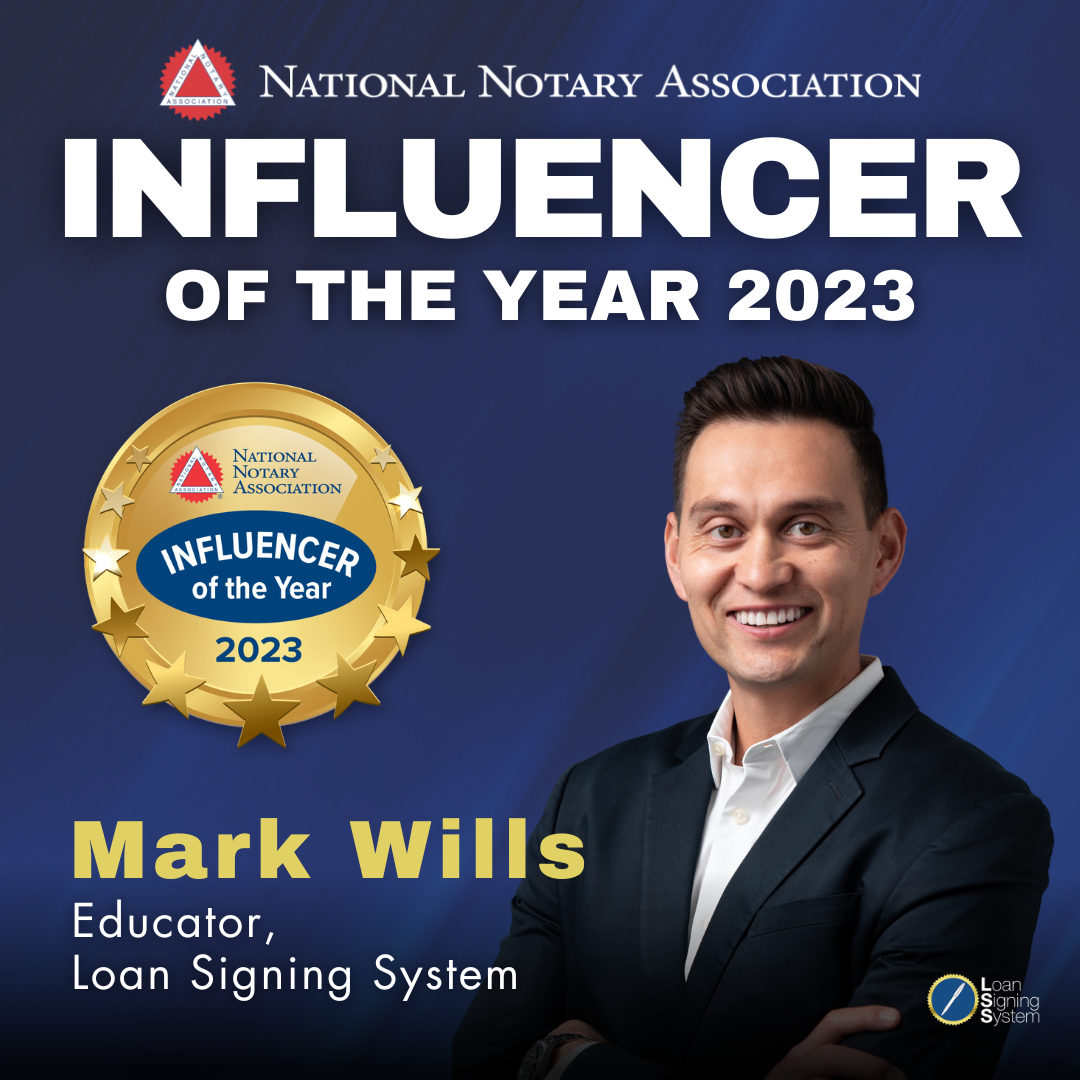

By Mark Wills - Course Instructor of the Loan Signing System, Forbes Real Estate Council Member, and Best-Selling Author

As a Notary Loan Signing Agent, You Can Get Signing Service Business or Direct Escrow Business — and There are Pros and Cons to Each.

Some notary loan signing agents stick with signing services for the sake of convenience, while others choose to bypass signing services and work directly for escrow officers, loan officers, and real estate agents.

Before I begin, let me first say that this is all personal preference — what may be a pro to one person, could be a con to someone else. So let's examine both methods of getting loan signing jobs in more detail...

What Are the Pros of Using Loan Signing Services to Get Business as a Notary Loan Signing Agent?

1) No sales are required

To get loan signing service business, you simply enter your name in databases and wait for the phone to ring. Leads literally just fall into your lap. 2) You are only judged by your work Punctuality, thoroughness, and not missing signatures or dates is key. You are not judged by what you look like, what you drive, or how many times a week you deliver Starbucks coffee. 3) No peer-to-peer interaction to get business or process orders You simply get an order, complete that order, then drop off the documents in FedEx — and the appointment is done. These are the primary reasons why many notary signing agents love signing service business. So Then, What are the Cons of Working for Loan Signing Service Companies as a Notary Loan Signing Agent?

1) You split the fee with the signing service

Usually, you only get paid around $100 per appointment... and I've heard of fees as low as $60 — leaving about $50 to $90 on the table for every loan signing job that you do. 2) You have to print the loan documents yourself This is because signing services choose email as the method of getting the loan documents to you before each appointment. Therefore, you’ll need to purchase a dual tray printer; one that prints legal and letter sized paper, along with a supply of ink and paper. These additional costs can eat into your bottom line. 3) You have to drop off loan documents at FedEx once the appointment is over Though this may not seem like too big of an hurdle, understand that even if you complete a signing late in the day, you’re still expected to make it to FedEx on time. 4) There's typically a 30-day delay in payment The reason for this slow turnaround time is because the escrow company must first pay the signing service for the job you complete, and then once those funds are received, the signing service can pay you... and this process can take time. You can look at working with signing services like this: In exchange for having loan signing jobs sent to you automatically, you receive a reduced fee, have to print loan documents yourself, and must meet FedEx drop-off deadlines. However! I know many notary loan signing agents who see no problem with this tradeoff at all. Sure, they make a reduced fee but they have to do zero sales in order to get a steady stream of business. Once again, it simply boils down to perspective. The great news is if you don't like splitting the fee with someone else and you don't want to print loan documents on your own dime, there is the option of getting business directly from escrow officers, loan officers, and real estate agents. This method is what the industry calls 'direct escrow business' or 'direct loan signing business.' Here Are the Pros to Getting Direct Escrow Business as a Notary Loan Signing Agent:

1) You keep every penny of the signing fee, no splitting it with a signing service

What exactly does this mean for you as the notary signing agent? It means that you receive about $50 to $90 MORE per job... for the exact same work. 2) The escrow company prints out loan documents for you This huge convenience eliminates the recurring cost of ink and paper that detracts from the total amount of money your business generates each month. 3) Easy lead generation In other words... if one escrow officer, loan officer, or real estate agent uses you as a loan signing agent in their office and you do a great job, others in the office will follow. 4) No FedEx deadlines to make Meaning, if you have a 5PM appointment and there's traffic between you and the nearest FedEx location, no need to worry — the documents can simply be returned the next day, saving you time and stress. 5) You get paid quicker and directly from escrow As soon as escrow closes, checks are cut, and you get paid. The wait time of sending payment through a signing service is completely eliminated. What About the Cons of Direct Escrow Business as a Notary Loan Signing Agent?

1) You’ll have to learn to sell yourself

Most sources of direct business (escrow officers, mortgage officers, and real estate agents) already have notary loan signing agents who they frequently use. Therefore, you'll need to convince them to pick you over someone else. Fortunately, Loan Signing System's five star-rated online course makes this skill easy with a number of word-for-word scripts you can use to get loan signings directly from mortgage professionals. Check it out here! 2) As in any type of sales, while giving out perks is not required, it is a kind thing to do Starbucks and lunches are nice — that's what I usually do to show appreciation to my mortgage professional clients. Understand, though, that these activities have a cost and time commitment. 3) While FedEx is rarely mandatory for local direct business, returning docs immediately is sometimes required For example, one day you may have a 10AM signing appointment because the escrow officer needs the loan documents back by noon to meet a funding deadline of 1PM. Although this doesn't happen often, it is a real possibility. 4) Typically, more is expected from you when working directly with escrow officers As a notary loan signing agent who does direct business, it is in your best interest to go above and beyond to be ensure the signing is perfect... even if the escrow officer makes a mistake. For instance, if they forget to include a certain document and ask you to go back out and get it signed (even though it is THEIR fault), you’re expected to do it, and often times for free. Notary signing agents do this simply because they want the repeat business that comes from outstanding service. 5) If you want to get repeat business from escrow companies, you’ll have to package loan documents Packaging loan documents generally takes an additional 10-15 minutes of work. But even more importantly, you have to learn how to package. Loan Signing System also offers a convenient course on packaging, along with a cheat sheet to make the job quick and simple, included at no additional cost to you. Click here to check it out today! In these ways, the grass isn't necessarily greener on the direct escrow business side... because although it pays more money, it puts more responsibility on your plate as well. Remember, you don't have to do any of the five things listed above in order to get business from signing services. BUT! The little bit of extra legwork just may be worth if you're earning $50 to $90 more per appointment.

As I pointed out at the beginning of this blog, it's simply about your unique perspective.

Regardless of the Method You Choose to Get Business, Notary Loan Signing Agents Still Make $75-$200 Per Hour-Long Appointment And that's what makes it a fantastic stream of part-time (and full-time!) income — all with no degree, prior experience, or special qualifications required to get started. The only thing you need is an active notary commission, and someone to teach you the loan documents. That's it. If you found this information helpful, awesome! There is so much more where that came from in my five star-rated Loan Signing System online training course for notary public loan signing agents. Thousands of people across the nation are using my techniques right now to make hundreds or even thousands of extra dollars every month. I'm Mark, I teach Loan Signing System, and I look forward to giving you more tools just like this to help you build a successful, efficient, and lucrative notary loan signing business today! Click the link below to learn how to make money as a notary signing agent: |

About the AuthorMark Wills is a Forbes Real Estate Council member, Loan Signing System Course Instructor & mentor to over 10,000 notary public business owners, and the National Notary Association's Influencer of the Year! Mark Wills is the course instructor of the #1 rated Loan Signing System notary public signing agent training course.

Loan Signing System has thousands of 5-star reviews and has transformed the fortunes of thousands of notary public business owners across the country! ⭐️⭐️⭐️⭐️⭐️ Click the link below to get the course! Archives

July 2024

|

- Homepage

- Courses

- Events

- Testimonials

-

FREE RESOURCES

- Get FREE Training

- 9 Reasons to Be a Signing Agent

- How To Become a Successful Signing Agent in 9 Steps

- How to Become a Notary Public

- Is This Right For You?

- Signing Service Owners Hire Notary Public Signing Agents

- Set Up a Google Business Profile for Notaries

- Four Ways to Get Signing Agent Business

- What is Remote Online Notarization RON?

- How to Get More Notary Jobs: FREE NNA Training

- How to Get More Notary Jobs

- How to Make More Money This Year

- LSS Signing Service Database

- Avoid Common Signing Agent Mistakes

- What Are Tax Deductions?

- Notary Hacks - Episode 1 >

- Maximize Your Notary Tax Deductions

- Snapdocs Interview

-

Notary Training

-

12 Ways to Make Money as a Notary

>

- Remote Online Notarization - Income Potential

- Apostille Agent - Income Potential

- Field Inspector - Income Potential

- Wedding Officiant - Income Potential

- Process Serving - Income Potential

- Permit Runner - Income Potential

- Estate Planning Notarizations - Income Potential

- Advanced Health Care Notarizations - Income Potential

- Mobile Fingerprinting - Income Potential

- Correctional Facilities Notarizations - Income Potential

- I-9 Verification

- Best Kept Secret for Notary Income

- Complete Notary Mentorship

-

12 Ways to Make Money as a Notary

>

- Blog and More!

- Student Login

- FAQ

- Homepage

- Courses

- Events

- Testimonials

-

FREE RESOURCES

- Get FREE Training

- 9 Reasons to Be a Signing Agent

- How To Become a Successful Signing Agent in 9 Steps

- How to Become a Notary Public

- Is This Right For You?

- Signing Service Owners Hire Notary Public Signing Agents

- Set Up a Google Business Profile for Notaries

- Four Ways to Get Signing Agent Business

- What is Remote Online Notarization RON?

- How to Get More Notary Jobs: FREE NNA Training

- How to Get More Notary Jobs

- How to Make More Money This Year

- LSS Signing Service Database

- Avoid Common Signing Agent Mistakes

- What Are Tax Deductions?

- Notary Hacks - Episode 1 >

- Maximize Your Notary Tax Deductions

- Snapdocs Interview

-

Notary Training

-

12 Ways to Make Money as a Notary

>

- Remote Online Notarization - Income Potential

- Apostille Agent - Income Potential

- Field Inspector - Income Potential

- Wedding Officiant - Income Potential

- Process Serving - Income Potential

- Permit Runner - Income Potential

- Estate Planning Notarizations - Income Potential

- Advanced Health Care Notarizations - Income Potential

- Mobile Fingerprinting - Income Potential

- Correctional Facilities Notarizations - Income Potential

- I-9 Verification

- Best Kept Secret for Notary Income

- Complete Notary Mentorship

-

12 Ways to Make Money as a Notary

>

- Blog and More!

- Student Login

- FAQ