|

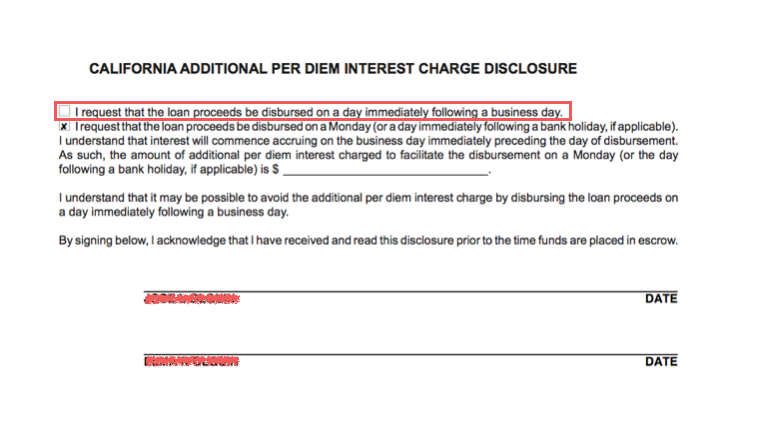

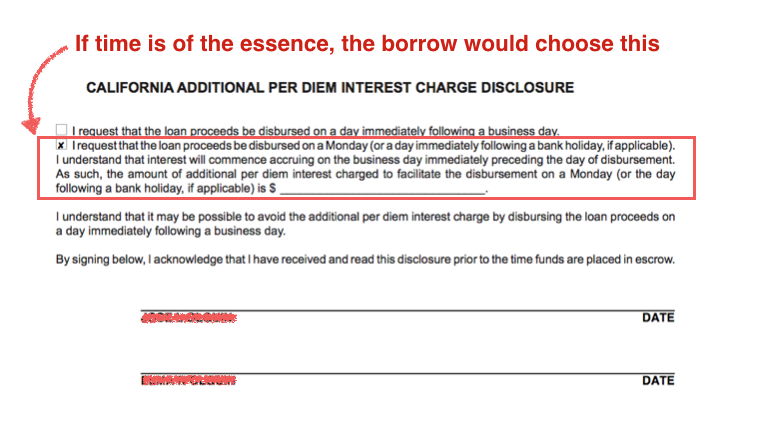

By Mark Wills - Course Instructor of the Loan Signing System and Forbes Real Estate Council Member I’m frequently asked by loan signing agents: How do I explain the California Per Diem Interest Disclosure form?But before I tell you exactly how to explain this to a borrower, you need to understand what this particular document is saying. The easiest way to put it is this page tells the borrower that they owe interest to the lender the day the loan gets wired to escrow, not when escrow closes. Allow me to elaborate: Let's say the loan funds on November 15th. That means the borrower owes interest to the lender starting on November 15th through the end of the month, November 30th. Pretty simple, right? But, escrow might close the loan one day or even a few days after November 15th, especially if it’s a weekend or holiday. Keep in mind, while escrow always does their best to close the loan the same day they receive the wire from the lender, closing the loan the next is business day is a regular practice. So if escrow can't close the loan the same day they receive the money from the lender, then the borrower pays interest on a loan that isn't even theirs yet. This can potentially become an issue if the lender sends the money to escrow on a Friday but escrow doesn't close the file until Monday. Therefore, the borrower has to pay three days of interest from Friday (the day the money leaves the bank) to Monday before escrow actually closes the loan. The same scenario happens if escrow receives the money the day before a holiday. So in our example above, the borrower may start paying interest on November 15th, but the loan actually closes escrow on November 18th. Now here is where it gets tricky - you may notice two boxes on the lower half of the page. Obviously, one needs to be checked… but which one? Answer: It depends on whether or not there’s time pressure for the loan to close. Let’s talk about the two options that the borrower can choose from in the form: The first option states “I elect disbursement of my loan proceeds to occur on any day BUT a Monday” or “I request the loan proceeds to be disbursed within one day of the funding date.” This may be worded a little differently from lender to lender, but you should be able to understand what they are talking about by reading the options. By checking the box above, the borrower is instructing escrow to fund on a day that will prevent extra days of interest being paid before the loan closes. It seems apparent that a borrower’s best choice is to check the box that prevents paying any interest over a weekend. Who wants to pay extra days of interest without actually having the loan closed and in place? But this isn’t always going to be the borrower’s best choice (because it could delay closing for a day). So let's now talk about the second box: If the first box prevents a loan from being closed on a Monday so the borrower avoids paying extra interest (even if it means a later closing date), then the second box states that the borrower is okay with a loan closing on Monday, or on any day for that matter (to close the loan on the earliest possible date). By checking this box, the borrower understands there is a chance that they may responsible for interest over a weekend or over a holiday, even though the loan has not yet been funded. So here are a couple of scenarios in which the borrower may choose to check the second box: Imagine if the borrower has a rate lock that is about to expire and the loan has to close by Monday or a day following a holiday to keep their interest rate the same. Checking the first box could delay funding and allow the rate lock to expire, causing the borrower to have a higher interest rate, and therefore a higher monthly payment and total loan cost. In another potentially problematic scenario is if, by contract, the loan has to close on a Monday. In both cases, the borrower should know if timing is of the essence. So, how do I explain this document when I am at a loan signing? I simply say, "this form says you have to pay interest the day the loan funds". "If you don't believe that your loan needs to fund quickly, this box (pointing to the first box) says you don't want to be responsible for any additional days of interest, even if it means a delayed closing by a couple of days." "If you believe that your loan needs to fund as soon as possible, perhaps you have a rate lock that’s expiring or you have to close by a certain date, then this box here (pointing to the second box) says to fund as soon as possible and there may be a few days of interest per day as a result." This will cause either one of two responses from the borrower:

Once again, we cannot give advice, but we can be educated about what each box means. Notice how I simply read what each box says and let them make the decision. That is a characteristic of a good loan signing agent. And now that you know what the Per Diem Interest Disclosure form says, you’re one step closer to becoming an expert loan signing agent. Be sure to subscribe to my email list to get regular loan signing agent tips and best practices like this one here. And when you’re ready to take your loan signing agent career to the next level and make great part-time income, be sure to get my loan signing system course by clicking the link below! About: The Loan Signing System is the best way to make great money part-time on your own schedule. Learn to become a notary public loan signing agent today and supplement your income! The Loan Signing System is a boot-camp style course that will teach you, step-by-step, how to become an expert signing agent. Click the link above to get started today.

|

About the AuthorMark Wills is a Forbes Real Estate Council member, Loan Signing System Course Instructor & mentor to over 10,000 notary public business owners, and the National Notary Association's Influencer of the Year! Mark Wills is the course instructor of the #1 rated Loan Signing System notary public signing agent training course.

Loan Signing System has thousands of 5-star reviews and has transformed the fortunes of thousands of notary public business owners across the country! ⭐️⭐️⭐️⭐️⭐️ Click the link below to get the course! Archives

July 2024

|

- Homepage

- Courses

- Events

- Testimonials

-

FREE RESOURCES

- Get FREE Training

- 9 Reasons to Be a Signing Agent

- How To Become a Successful Signing Agent in 9 Steps

- How to Become a Notary Public

- Is This Right For You?

- Signing Service Owners Hire Notary Public Signing Agents

- Set Up a Google Business Profile for Notaries

- Four Ways to Get Signing Agent Business

- What is Remote Online Notarization RON?

- How to Get More Notary Jobs: FREE NNA Training

- How to Get More Notary Jobs

- How to Make More Money This Year

- LSS Signing Service Database

- Avoid Common Signing Agent Mistakes

- What Are Tax Deductions?

- Notary Hacks - Episode 1 >

- Maximize Your Notary Tax Deductions

- Snapdocs Interview

-

Notary Training

-

12 Ways to Make Money as a Notary

>

- Remote Online Notarization - Income Potential

- Apostille Agent - Income Potential

- Field Inspector - Income Potential

- Wedding Officiant - Income Potential

- Process Serving - Income Potential

- Permit Runner - Income Potential

- Estate Planning Notarizations - Income Potential

- Advanced Health Care Notarizations - Income Potential

- Mobile Fingerprinting - Income Potential

- Correctional Facilities Notarizations - Income Potential

- I-9 Verification

- Best Kept Secret for Notary Income

- Complete Notary Mentorship

-

12 Ways to Make Money as a Notary

>

- Blog and More!

- Student Login

- FAQ

- Homepage

- Courses

- Events

- Testimonials

-

FREE RESOURCES

- Get FREE Training

- 9 Reasons to Be a Signing Agent

- How To Become a Successful Signing Agent in 9 Steps

- How to Become a Notary Public

- Is This Right For You?

- Signing Service Owners Hire Notary Public Signing Agents

- Set Up a Google Business Profile for Notaries

- Four Ways to Get Signing Agent Business

- What is Remote Online Notarization RON?

- How to Get More Notary Jobs: FREE NNA Training

- How to Get More Notary Jobs

- How to Make More Money This Year

- LSS Signing Service Database

- Avoid Common Signing Agent Mistakes

- What Are Tax Deductions?

- Notary Hacks - Episode 1 >

- Maximize Your Notary Tax Deductions

- Snapdocs Interview

-

Notary Training

-

12 Ways to Make Money as a Notary

>

- Remote Online Notarization - Income Potential

- Apostille Agent - Income Potential

- Field Inspector - Income Potential

- Wedding Officiant - Income Potential

- Process Serving - Income Potential

- Permit Runner - Income Potential

- Estate Planning Notarizations - Income Potential

- Advanced Health Care Notarizations - Income Potential

- Mobile Fingerprinting - Income Potential

- Correctional Facilities Notarizations - Income Potential

- I-9 Verification

- Best Kept Secret for Notary Income

- Complete Notary Mentorship

-

12 Ways to Make Money as a Notary

>

- Blog and More!

- Student Login

- FAQ