|

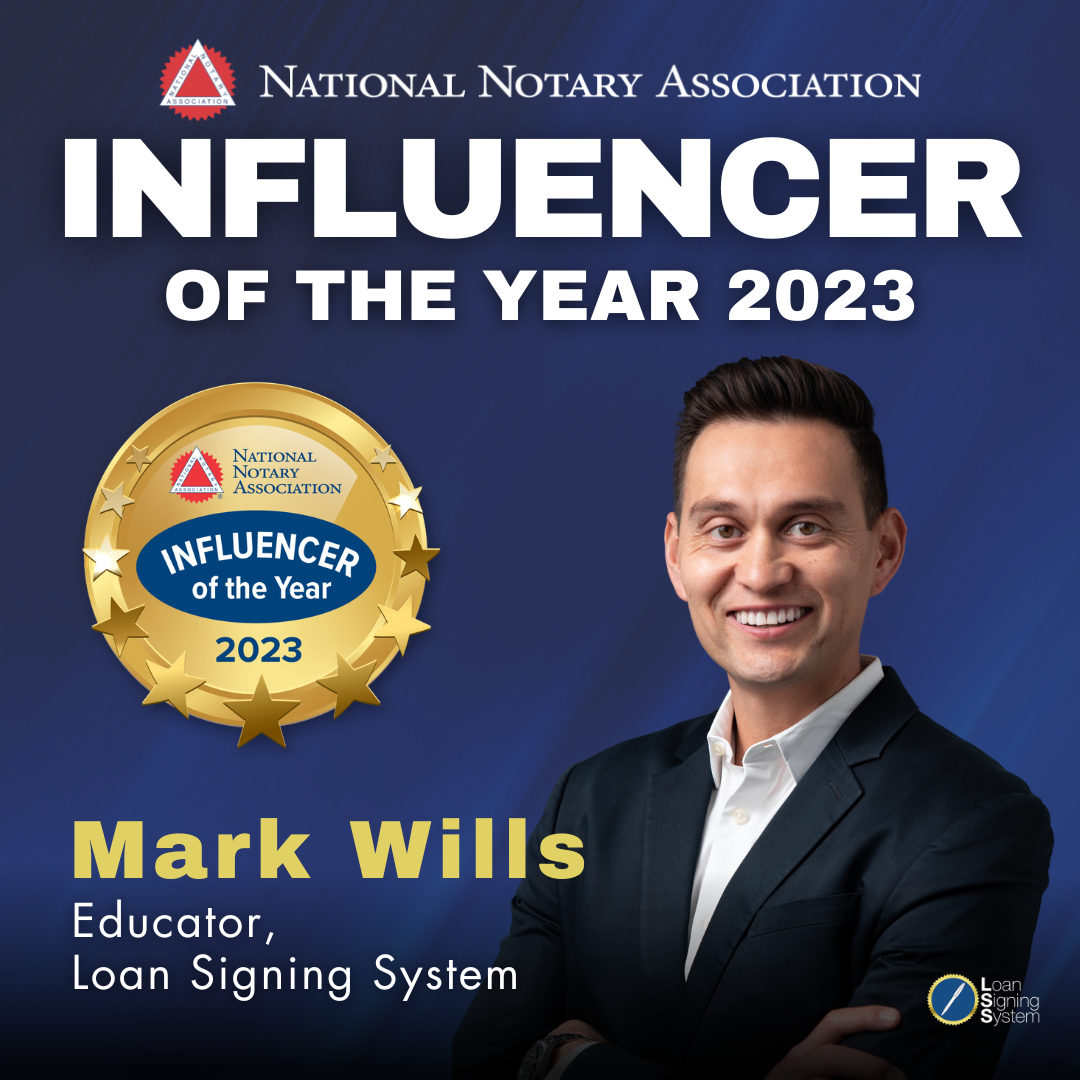

By Mark Wills - Course Instructor of the Loan Signing System, Forbes Real Estate Council Member, and Best-Selling Author

A great question I frequently receive from notary loan signing agents is, "How much should I charge to do a loan signing job?"

There’s a lot of information on the internet today about having a comprehensive notary public loan signing agent fee strategy. Some resources and blogs tell you to set different fees based on appointment time, driving time, printing time, number of pages printed, number of people signing, and even what time of the month it is (later in the month is usually busier)...

The Real Question Should Be: Do Fee Strategies Work for Notary Public Loan Signing Agents?

And the answer is: absolutely not.

Let me first lend myself a little credibility on this topic by saying that I am a notary loan signing agent who started my career working for signing services, I currently own a nationwide signing service, and I have worked directly with escrow officers for more than 15 years. So it is with unquestioning certainty that I say — pricing strategies rarely work for signing agents, or any business at all for that matter. This is because notary pricing strategies typically only work for services and products that have inelastic demand. In other words, consumers have no choice but to pay a higher price because they (in a literal sense) have no other option. A perfect example of products with inelastic demand is hotel rooms in Las Vegas. During slow times, hotels charge under $100 in an attempt to win your business. But when tourism picks up (think New Years Eve), the same rooms could run for $300 or more since guests have no alternative choice. When it comes to notary loan signing agents, on the other hand... signing services, escrow officers, and mortgage officers do have choices. So having a sliding fee structure based on things like time of month or number of pages printed, simply isn't the best strategy if you want to be a busy loan signing agent. What if your hair stylist told you that since he is busy, he is going to charge you double for the same exact haircut? What if your favorite restaurant charged you $25 more for dinner just because it was the 30th day of the month? There are more hairdressers and restaurants in your town and you would just pick a competitor who doesn't have a sliding fee schedule. Loan signing agents are no different. If You Want to Charge More Money for Each & Every Line Item, a Signing Agent with a Simple Pricing Structure Will be Picked for That Signing Instead of You.

At my signing service I've seen some notaries who want to charge more per signing during rush hour. I've heard of some who want to charge more if they have to travel more than 20 miles. I've even come across some who want to charge more when it's the last day to sign.

I've seen many more loan signing agents who do not adjust their pricing at all. The truth of the matter is that a signing agent with a comprehensive fee structure is slow signing agent. Plain and simple. It's a bad idea to adopt a fee schedule. If your goal is to be a successful notary loan signing agent, it’s important to understand that signing services and escrow officers want to work with signing agents who are reliable — and having an easy-to-understand, consistent fee structure is part of being reliable. But even more importantly... The Main Reason to Avoid Having a Fee Schedule is TRID Disclosures

Once escrow and the lender have disclosed a signing fee to the borrower on a final closing disclosure, they cannot change it. By law. So if you tell an escrow officer that you charge an extra $25 on a rush hour signing, many times they have no choice but to move on because the loan signing fee has already been disclosed. What's worse... if you start asking for more money, you come off as an uneducated signing agent who knows nothing about TRID disclosures.

Here is my advice: pick a fee that you are happy with and stick to it. If you are a signing service notary, choose an acceptable fee of $90 or $100. If you work for escrow companies, I suggest $150 per signing. Yes, some signings will be a doozy but on the other hand, some will be super easy. In my experience, it all averages out in the end. So What Exactly is 'Fair' When it Comes to Loan Signing Fees?

Another great question.

Notary loan signing agents commonly ask questions like: is it necessarily 'fair' that signing services or escrow officers will pay you the same fee to do a signing where you pick up loan documents, or require a drop off, or if there are three signers versus two, or if a signing takes two hours because there are over 150 pages? Very valid points! At the end of the day, sometimes you come out ahead and sometimes you don’t. But on the flip side, do you ask for LESS money when the loan docs are only 80 pages, or if the signing takes 30 minutes, or if the appointment is down the street from your house? Of course not. The bottom line is this — having a simple, flat fee structure will win you more signings than you will lose by having a comprehensive fee schedule. And that means more money in your pocket at the end of the day. The only time I feel it's appropriate to charge more money is if you are doing a first and second loan. In this case, I advise charging a signing service an additional $50 dollars for a second and $75 if you are working directly with an escrow company. I should also clarify: I'm not encouraging you to accept low-ball $75 signings or drive two hours to every single appointment. What I am saying is to choose a flat fee that you are comfortable with, and don't be afraid to say no if the fee doesn’t meet your needs. Signing services and escrow officers want to work with someone who they know they can count on. And as in any business, reliability is key — clients don't like surprises. Consistent pricing and flawless work are equally important. Show me a signing agent with a simple fee structure, and I will show you a signing agent who always gets the first call or text when a signing is available. If you found this information helpful, awesome! There is so much more where that came from in my five star-rated Loan Signing System online training course for notary public loan signing agents. Thousands of people across the nation are using my techniques right now to make hundreds or even thousands of extra dollars every month. I'm Mark, I teach Loan Signing System, and I look forward to giving you more tools just like this to help you build a successful, efficient, and lucrative notary loan signing business today! |

About the AuthorMark Wills is a Forbes Real Estate Council member, Loan Signing System Course Instructor & mentor to over 10,000 notary public business owners, and the National Notary Association's Influencer of the Year! Mark Wills is the course instructor of the #1 rated Loan Signing System notary public signing agent training course.

Loan Signing System has thousands of 5-star reviews and has transformed the fortunes of thousands of notary public business owners across the country! ⭐️⭐️⭐️⭐️⭐️ Click the link below to get the course! Archives

July 2024

|

- Homepage

- Courses

- Events

- Testimonials

-

FREE RESOURCES

- Get FREE Training

- 9 Reasons to Be a Signing Agent

- How To Become a Successful Signing Agent in 9 Steps

- How to Become a Notary Public

- Is This Right For You?

- Signing Service Owners Hire Notary Public Signing Agents

- Set Up a Google Business Profile for Notaries

- Four Ways to Get Signing Agent Business

- What is Remote Online Notarization RON?

- How to Get More Notary Jobs: FREE NNA Training

- How to Get More Notary Jobs

- How to Make More Money This Year

- LSS Signing Service Database

- Avoid Common Signing Agent Mistakes

- What Are Tax Deductions?

- Notary Hacks - Episode 1 >

- Maximize Your Notary Tax Deductions

- Snapdocs Interview

-

Notary Training

-

12 Ways to Make Money as a Notary

>

- Remote Online Notarization - Income Potential

- Apostille Agent - Income Potential

- Field Inspector - Income Potential

- Wedding Officiant - Income Potential

- Process Serving - Income Potential

- Permit Runner - Income Potential

- Estate Planning Notarizations - Income Potential

- Advanced Health Care Notarizations - Income Potential

- Mobile Fingerprinting - Income Potential

- Correctional Facilities Notarizations - Income Potential

- I-9 Verification

- Best Kept Secret for Notary Income

- Complete Notary Mentorship

-

12 Ways to Make Money as a Notary

>

- Blog and More!

- Student Login

- FAQ

- Homepage

- Courses

- Events

- Testimonials

-

FREE RESOURCES

- Get FREE Training

- 9 Reasons to Be a Signing Agent

- How To Become a Successful Signing Agent in 9 Steps

- How to Become a Notary Public

- Is This Right For You?

- Signing Service Owners Hire Notary Public Signing Agents

- Set Up a Google Business Profile for Notaries

- Four Ways to Get Signing Agent Business

- What is Remote Online Notarization RON?

- How to Get More Notary Jobs: FREE NNA Training

- How to Get More Notary Jobs

- How to Make More Money This Year

- LSS Signing Service Database

- Avoid Common Signing Agent Mistakes

- What Are Tax Deductions?

- Notary Hacks - Episode 1 >

- Maximize Your Notary Tax Deductions

- Snapdocs Interview

-

Notary Training

-

12 Ways to Make Money as a Notary

>

- Remote Online Notarization - Income Potential

- Apostille Agent - Income Potential

- Field Inspector - Income Potential

- Wedding Officiant - Income Potential

- Process Serving - Income Potential

- Permit Runner - Income Potential

- Estate Planning Notarizations - Income Potential

- Advanced Health Care Notarizations - Income Potential

- Mobile Fingerprinting - Income Potential

- Correctional Facilities Notarizations - Income Potential

- I-9 Verification

- Best Kept Secret for Notary Income

- Complete Notary Mentorship

-

12 Ways to Make Money as a Notary

>

- Blog and More!

- Student Login

- FAQ