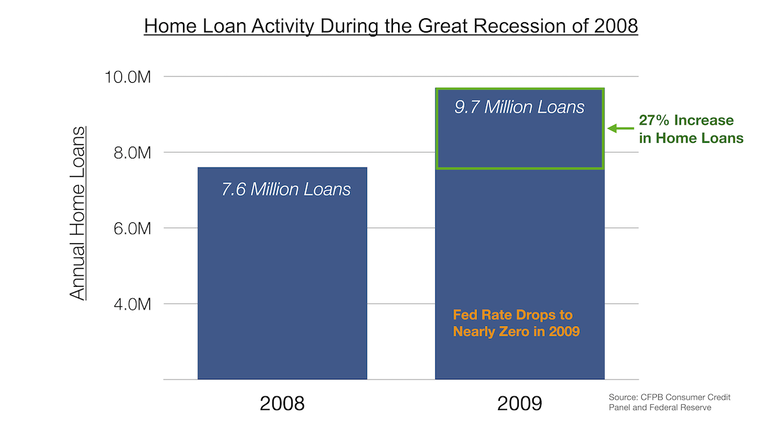

The Federal Government is instituting several policies designed to minimize the impact of an expected recession.

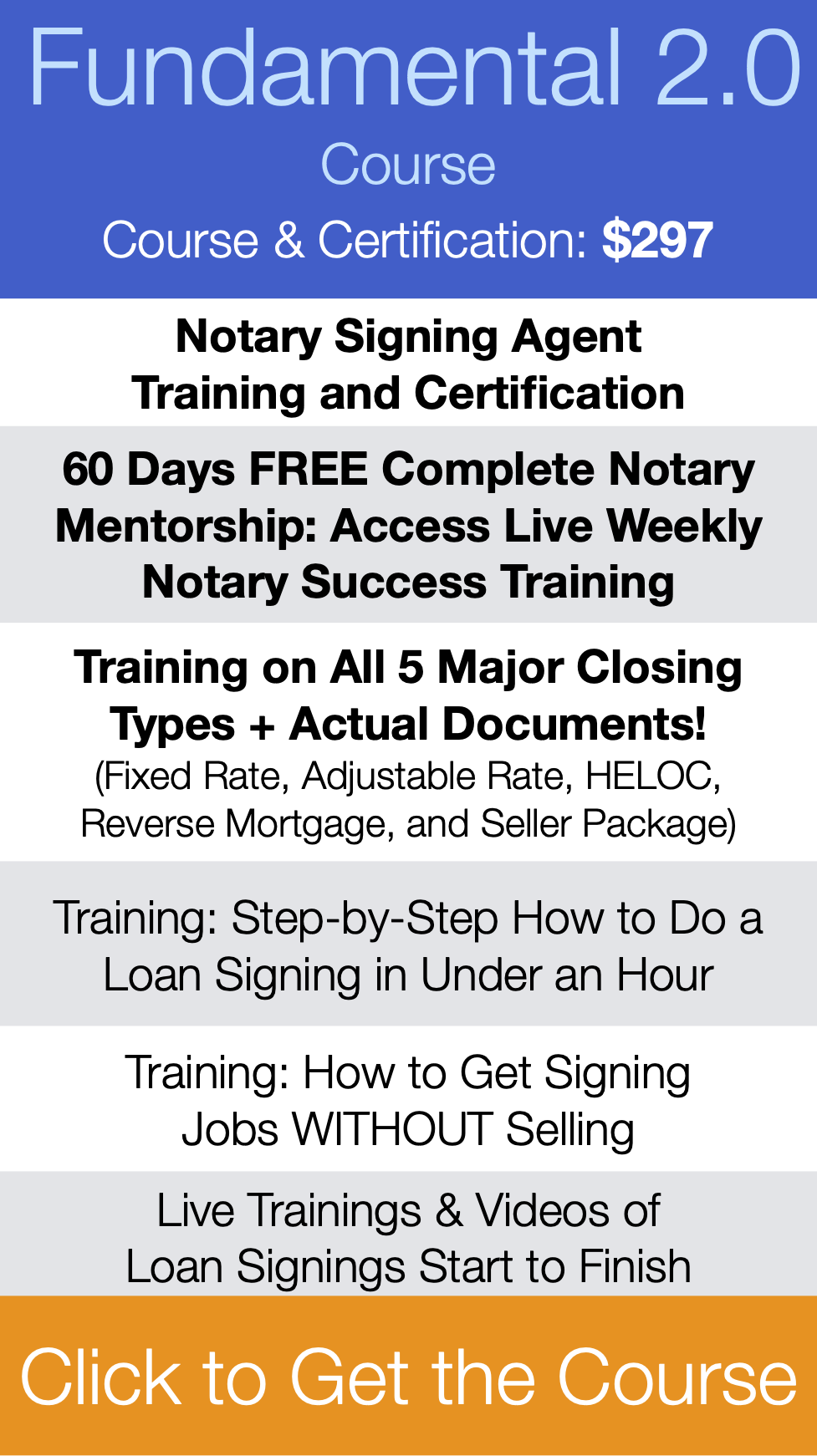

How An Uncertain or Bad Economy Can Affect Loan Signing Agents

Are you wondering how to make money in a recession as a notary public?

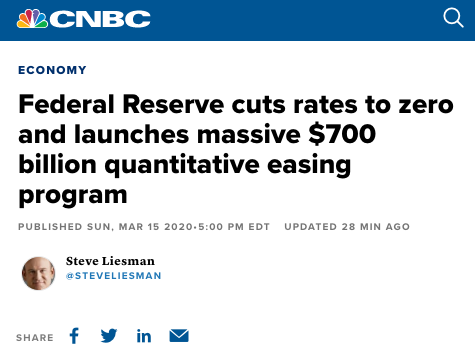

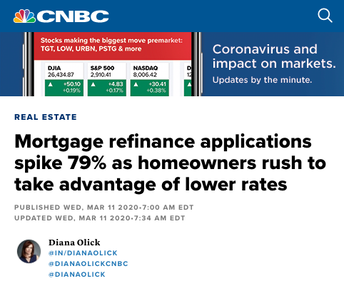

Discover what a potential recession, the Federal Funds Rate target going to ZERO, and the $700 billion+ quantitative easing program could mean for the real estate industry and for you as a notary public loan signing agent.