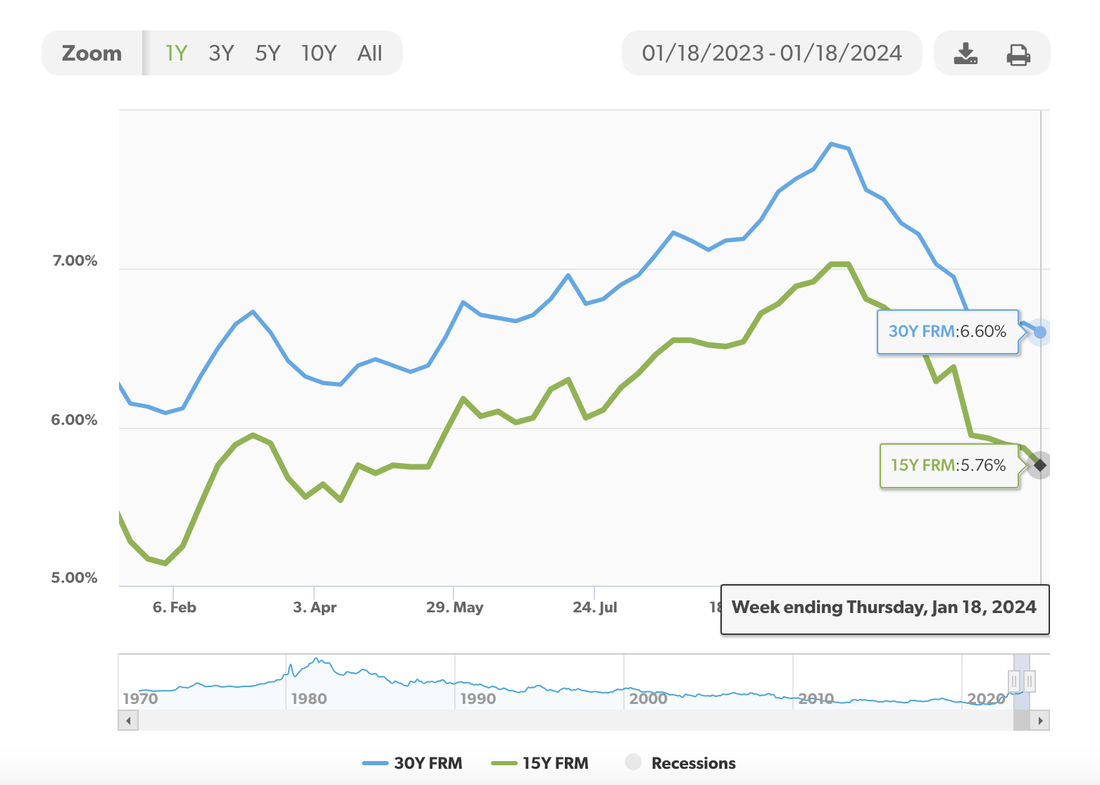

Home Mortgage Rates Are at the Lowest in 7 Months

Mortgage Rates Drop Down to Lowest Level

Since May 2023!

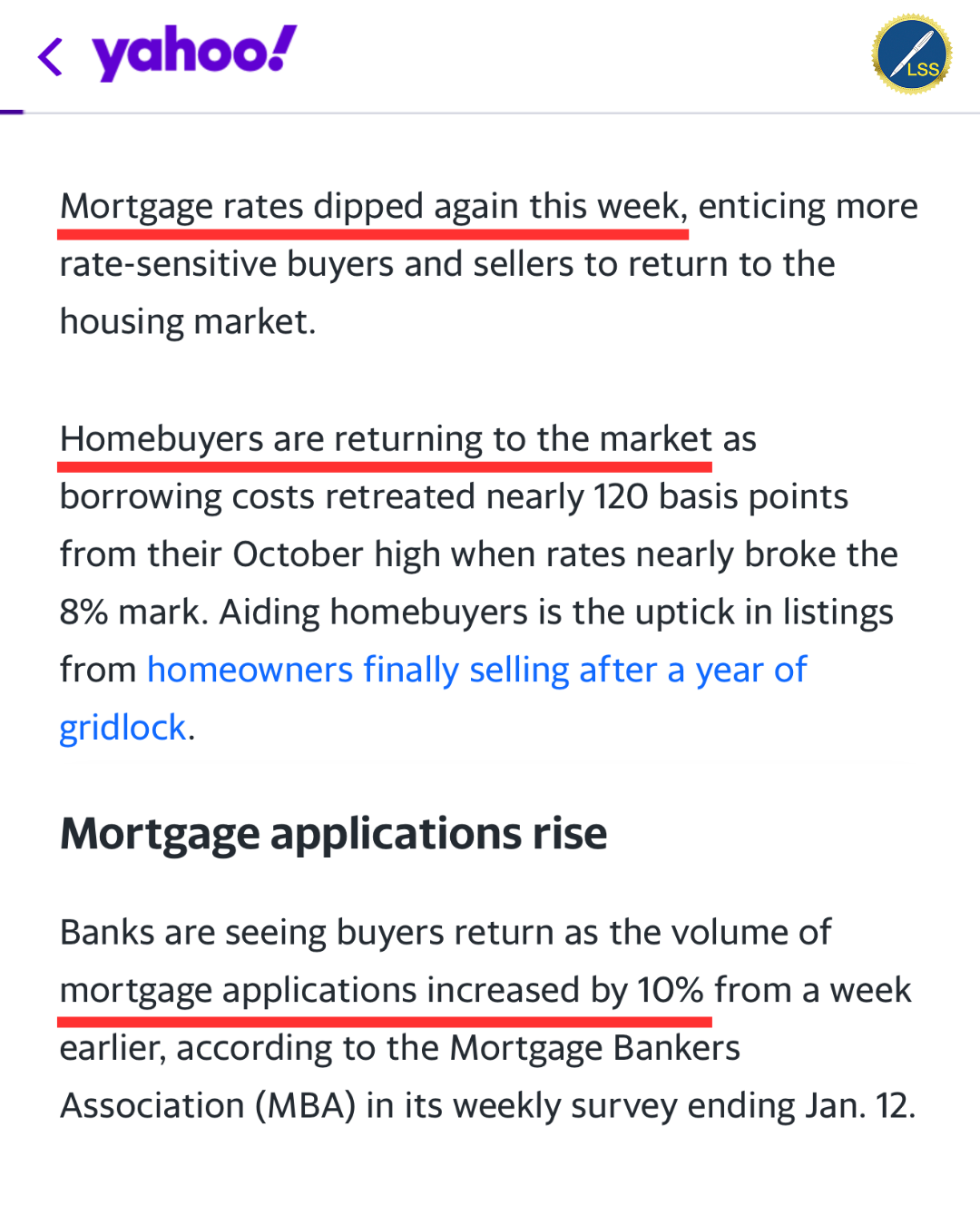

Yahoo Finance, CNN, Freddie Mac Are Reporting Great News for

Real Estate Professionals!

Discover what the lowest interest rates since COVID will do for your signing agent business and how long it's expected to last!